EGA | Compliance

Expert AML/CFT/CPF and other compliance and due diligence services, globally.

About EGA Compliance

EGA Compliance is a the dedicated compliance consulting arm of Evelyn Group Associates.

Powered by a network of independent compliance practitioners with industry and regulator experience, EGA Compliance provides a full suite of anti-money laundering, counter-terrorist financing and counter-proliferation financing (AML/CFT/CPF) compliance services within the scope of your regulatory framework.

Our mission is to help regulated businesses and discerning clients navigate complex compliance and financial crime prevention challenges with confidence and precision.

Our approach combines expertise, strategic insight, and personalised support to ensure our clients achieve their regulatory and risk management goals while mitigating financial crime risks.

AML/CFT/CPF COMPLIANCE SERVICES

We provide tailored solutions to meet your anti-money laundering, counter-financing of terrorism, and counter-proliferation financing compliance needs.

AML/CFT/CPF Business Risk Assessments (BRA)

Every regulated entity must conduct a robust Business Risk Assessment. We evaluate your customer base, geographic exposure, delivery channels, and product offerings to identify risks, threats, and vulnerabilities. Leveraging national risk assessments and regulatory frameworks, we help you determine inherent, mitigated, and residual risks.

AML Documentation Drafting

We create essential compliance documents, including customer acceptance policies, customer risk assessment methodologies, and onboarding templates tailored to your needs.

Software and Tools Assistance

Selecting the right compliance tools is critical. We guide you in adopting and integrating sanctions screening tools, KYC software, and other essential technologies.

Policies and Procedures Development (P&P)

Compliance starts with effective policies. We draft customised AML/CFT/CPF policies and procedures that align with your territory's regulatory playbook and reflect your business’s unique operational complexities.

Compliance Audits and Mock Examinations

Our expert team reviews your compliance documentation and conducts sample testing of customer files to assess your readiness for regulatory inspections.

Training and Awareness

Our team designs and delivers bespoke training programmes for your staff members to ensure your team is well-equipped to protect your business and act in compliance with your obligations

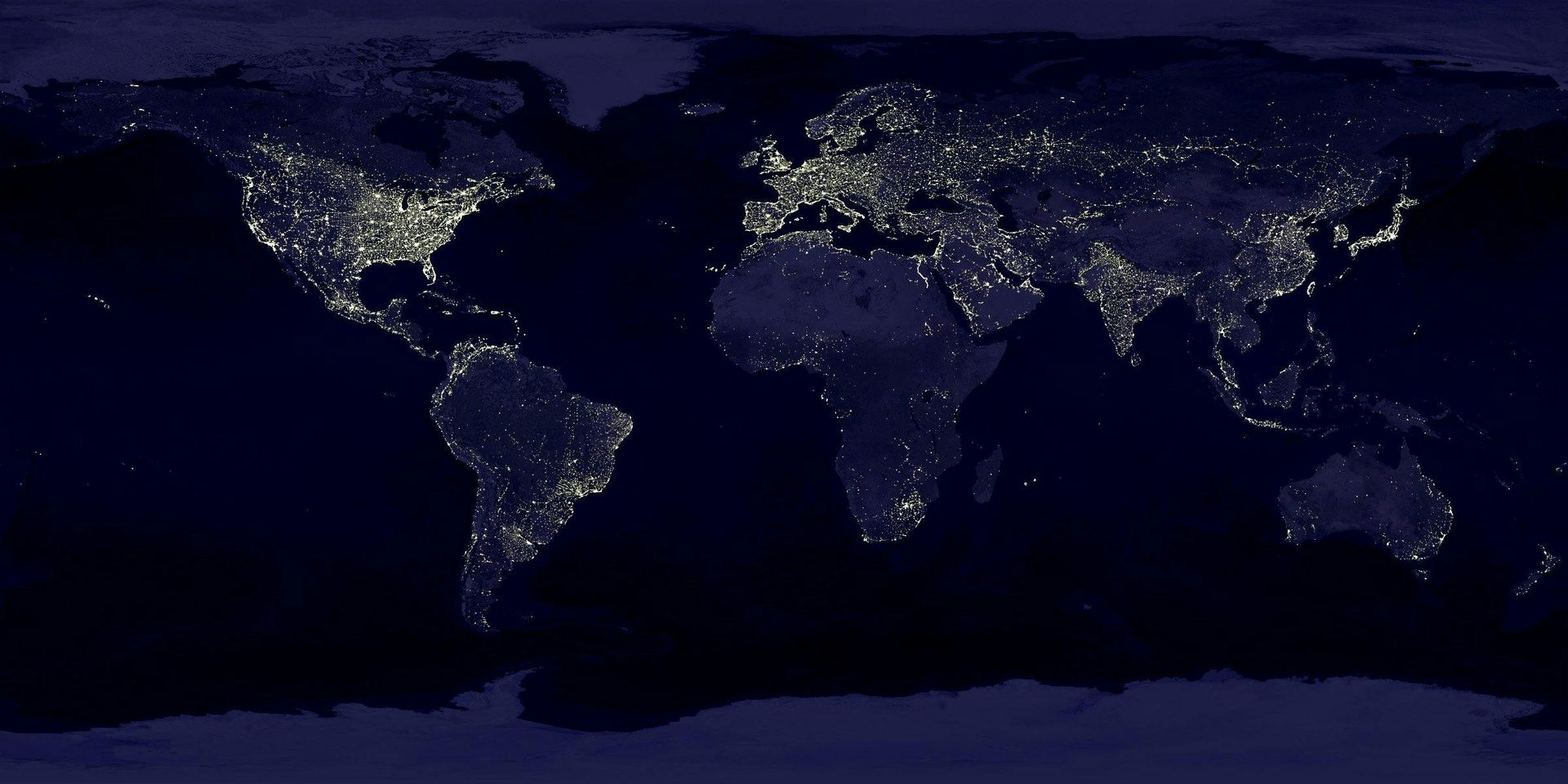

Our geographical reach

EGA prides itself on being a global, decentralised operation. This enables us to attract experts across a range of jurisdictions, knowledgeable in multiple regulatory frameworks. As a result, we can provide expert compliance solutions informed by international best practices globally, including the following:

Jersey

As a well-established international financial centre, Jersey implements strict AML/CFT/CPF regulations targeted at financial and non-financial businesses under the supervision of the Jersey Financial Services Commission (JFSC).

Contrary to popular belief, Jersey is far from being an offshore haven with lax regulation. Jersey's robustness in financial crime prevention was recently highlighted in Jersey's MONEYVAL Mutual Evaluation Report. Maintaining this reputation requires businesses to be particularly diligent with regards to their AML/CFT/CPF frameworks.

Whatever your industry, our team can help guide you through the complexity of local laws and regulations, and ensure your business is up to scratch with the regulatory obligations and expectations.

By Moral Rock.

AIFC

AIFC has emerged as a key financial hub in Central Asia, offering a business-friendly environment with a robust regulatory framework. The AIFC implements stringent AML/CFT/CPF regulations under the oversight of the Astana Financial Services Authority (AFSA), ensuring compliance with international standards, including FATF recommendations.

A key feature of the AIFC is its independent legal framework based on English common law principles, which provides a transparent and predictable environment for businesses. This makes it an attractive destination for financial institutions, investment funds, and corporate entities operating across diverse sectors.

Our team supports businesses navigating the AIFC’s compliance requirements, including assistance with AML/CFT policies, risk assessments, and adherence to the regulatory obligations established by AFSA. We ensure your operations remain compliant while taking advantage of the unique opportunities offered by this dynamic financial centre.

Please note this service is temporarily unavailable for individuals and companies resident in the territory of the AIFC.

Malta

As a major financial centre within the European Union, Malta follows strict AML/CFT/CPF rules, with businesses overseen by:

- the Financial Intelligence Analysis Unit (FIAU)

- the Malta Financial Services Authority (MFSA)

- the Malta Gaming Authority (MGA)

- the Malta Business Registry (MBR)

- the Sanctions Monitoring Board (SMB)

Depending on the nature of the business and the type of supervision, each of the above regulators may review your business for compliance with the national AML/CFT/CPF framework.

Our team will assist you with navigating the challenges associated with compliance, supervisory interventions, and risk management, ensuring your business is protected from the harmful effects of financial crime and non-compliance.

Our sectors & industries

Trust and Corporate Services Providers

Trust and Corporate Services Providers (TCSPs) are often subject to stringent AML/CFT regulations due to their role in managing entities, assets, and financial arrangements that may be misused for money laundering or other illicit activities.

Their involvement in creating complex corporate structures and handling beneficial ownership data places them under close regulatory scrutiny.

EGA Compliance supports TCSPs by providing tailored solutions to navigate beneficial ownership obligations, enhance record-keeping practices, and implement effective customer due diligence measures. Our expertise helps TCSPs strengthen compliance standards while ensuring operational efficiency and regulatory adherence.

Fund Managers and Administrators

Fund managers and administrators are critical players in the financial industry and are subject to strict AML/CFT regulations due to the inherent risks of money laundering and terrorist financing within investment activities. The global flow of funds, diverse investor profiles, and complex structures make this sector particularly vulnerable to financial crime.

EGA Compliance assists fund managers and administrators in ensuring compliance by developing tailored AML/CFT frameworks, including investor onboarding procedures, risk assessment methodologies, and ongoing monitoring practices. We help streamline compliance processes, reduce regulatory risks, and safeguard the integrity of your operations.

Please note that for Luxembourg-resident customers, this service is provided by a designated local partner.

Lawyers and Notaries

Lawyers and notaries are exposed to significant AML risks, especially when involved in financial transactions, property transfers, or trust formations. These professionals often act as intermediaries in high-value dealings, making them potential targets for those seeking to conceal illicit funds.

At EGA Compliance, we provide support by helping legal professionals implement robust AML frameworks, including customer due diligence measures, transaction monitoring protocols, and compliance audits. Our solutions ensure lawyers and notaries meet their regulatory obligations while maintaining the trust and confidentiality their clients expect.

Accountants and Auditors

Accountants and auditors play a pivotal role in financial reporting, tax compliance, and financial oversight, often working closely with sensitive financial data. Due to their access to client records and their involvement in high-value transactions, they are considered high-risk for facilitating money laundering and other financial crimes.

EGA Compliance provides specialized support to accountants and auditors by developing tailored AML frameworks, including risk-based customer due diligence processes, enhanced transaction monitoring, and training programs to identify red flags. Our expertise ensures you meet your regulatory obligations while protecting your reputation and clients’ trust.

Gaming and Gambling Operators

Gaming and gambling operators are prime targets for financial crime due to the cash-intensive nature of their operations and the global reach of online platforms. The sector is highly regulated to prevent money laundering and terrorist financing, requiring robust compliance measures to address these vulnerabilities.

EGA Compliance assists gaming and gambling operators in implementing effective AML measures, such as customer verification procedures, transaction monitoring, and reporting mechanisms for suspicious activity. We help operators establish compliance frameworks that align with regulatory requirements while maintaining operational efficiency.

Real Estate Agents

Real estate transactions are a well-known vehicle for money laundering due to their high value and complexity. Real estate agents are required to conduct customer due diligence and assess risks associated with property transactions, especially when dealing with offshore clients or unexplained sources of funds.

EGA Compliance supports real estate agents by developing robust AML policies, customer onboarding procedures, and risk assessment tools tailored to the sector. We ensure your compliance framework is strong enough to address regulatory requirements while facilitating smooth property transactions for your clients.

Commodities Traders & Intermediaries

Commodities traders and intermediaries operate in a high-risk environment where transactions often span multiple jurisdictions and involve significant sums of money. Despite the sector being largely unregulated, the risks of financial crime, such as money laundering and sanctions violations, remain substantial. An accidental breach or failure to comply with international standards can result in severe financial and reputational damage.

EGA Compliance helps commodities traders mitigate these risks by implementing due diligence as a key risk management tool. We assist in conducting thorough counterparty checks, sanctions screening, and transaction monitoring to protect your business and maintain the trust of your stakeholders.

High-Value Dealers

High-value dealers, including art galleries, luxury goods retailers, and precious metals traders, are attractive targets for money laundering due to the portability and value of their goods.

Regulatory frameworks often require dealers to implement robust AML measures to ensure compliance when handling large transactions.

EGA Compliance supports high-value dealers by designing customised AML policies, conducting customer due diligence, and offering training on identifying red flags. Our solutions ensure your business operates within the bounds of regulatory requirements while safeguarding against financial crime.

Other companies

For companies outside regulated sectors, compliance with AML/CFT standards is increasingly critical for maintaining strong corporate governance and fostering trust with service providers, partners, and clients.

Circumspect businesses recognise that financial crime risks, if unaddressed, can lead to financial losses, non-compliance penalties or reputational harm.

EGA Compliance provides tailored due diligence solutions as an essential risk management device. Whether it’s verifying counterparties, conducting transaction reviews, or aligning your operations with international compliance standards, our expertise helps businesses minimise risks while maintaining operational excellence.

Our approach

EGA Compliance is driven by experienced professionals with deep and varied expertise in the compliance industry. Our entrepreneurial mindset and client-focused approach set us apart in delivering solutions that meet diverse needs.

We serve regulated businesses, professionals supervised for AML purposes, and unregulated entities seeking to protect against financial crime.

To know what's cooking is in the nature of our business. We prioritise understanding your business needs before offering our services. That’s why every engagement includes:

01

Initial consultation

Reach out to us to arrange an initial discussion of your business needs. We discuss your business model, regulatory requirements, and goals to develop a custom compliance strategy.

02

Bespoke engagement plan

Receive a bespoke engagement plan. Based on our findings, we present a detailed proposal outlining scope, methodology, timelines, and fees.

03

Onboarding and engagement

Receive your personal fee proposal from your relationship manager. Once agreed, we onboard you and begin delivering tailored solutions that align with your business objectives.

04

Ongoing reporting

Benefit from the option to receive ongoing assessments and compliance reports to boost your compliance experience.

Ready to enhance your compliance experience? Contact us now:

We’d love to hear from you. Let's discuss how EGA Compliance can help you today.

Letters to:

71-75 Shelton Street, Covent Garden, London WC2H 9JQ, United Kingdom

Emails to:

admin@evelyngroup.net

Telegram to:

@EvelynEMEA

Contact us

Thank you for contacting us.

We will get back to you as soon as possible.

Uh oh, there was an error sending your message.

Please try again later or use another contact method.

EGA Compliance is brought to you by: